It’s been a scant 9 days (yeah, I know…) since Dear Leader spoke to the assembled masses in the Rose Garden to unveil his Big, Beautiful Tariffs. While the Art of the Deal personified struggled with a cardboard poster showing his “reciprocal” rates, the futures markets tumbled in real time.1 It was truly an awesome spectacle. While he announced the tariffs on a Tuesday, he built in a week before they went into effect.2 I guess he wanted to give American companies time to spool up new factories in Rust Belt states or something.

The markets did not share Trump’s enthusiasm for the tariffs however, with the Dow dropping over 1500 points both Thursday and Friday of last week, the first time that has ever happened in the history of the exchange. This week started with the decline leveling a bit, and then weird shit started to happen. There was a report that Trump was considering a 90 day pause on the tariffs, and the market rocketed up over 1,000 points. Until, that is, the White House shot down that rumor as Fake News, at which point the gains were immediately lost, and then some. Tuesday started with a modest rise, making up some of the lost ground and apparently stabilizing. Then around lunchtime Trump announced that he was doubling the tariffs on China, and word came out that the EU was considering their own reciprocal tariffs. By the close on Tuesday the Dow had dropped to 37,645, over 10.8% down from the April 2nd close of 42,225. Financial professionals were going ballistic and openly predicting a recession, while major Trump donors and allies were publicly calling for him to stop the bleeding. The anger even boiled up inside Trump’s inner circle as Elon Musk and Peter Navarro engaged in a sophomoric round of verbal jousting.

Not Even a Full Scaramucci

The tariffs were set to go into effect on Wednesday, April 9th, and the market opened rough. That is until shortly after 1pm, when Trump announced that he had caved. For those keeping score, they lasted a little more than a week from announcement to pause, and only a matter of hours from when they went into effect. (Except they… didn’t? More on that below.) His announcement came via official US Government Communications Medium Truth Social, of course. His bleat stated that he was doubling the tariffs on China while reducing all other tariffs to 10% for the duration of a 90 day pause.3 Markets skyrocketed, sycophants syco’d, and all was great in MAGA land again.

Of course, the media couldn’t help but breathlessly report on how the markets experienced their greatest one-day rise in 16 years4, as if Trump hadn’t caused the fire that they were giving him credit for extinguishing. Well, mostly. Kinda. The volume and depth of the ass-kissing was amazing, even for MAGA. There was a lot of it, and it was as disgustingly stupid as you can imagine. I would share a bunch, but we got a lot more shit to discuss, so I will just post my favorite, from The Forehead, Stephen Miller, aka Pee Wee German.5

Yeah, About All That Celebrating…

The stock market is a weird place, and people that understand these things should probably have been a bit more circumspect before dancing through the night on Wednesday. You see, there were a lot of questions that still remained unanswered regarding the pause. For example, the White House claimed that 75 countries had already contacted the United States, allegedly begging to make a deal with Dear Leader. But the Trump admin refused to identify the countries and still have not done so. Further, there was, and still remains, confusion as to which of the myriad tariffs that have been thrown about since January are still in effect.

The result of all this, along with China doubling down and US Treasury yields skyrocketing was another day where the Dow lost over 1,000 points. Suddenly all of the ridiculous victory laps taken by Team Trump looked as stupid as Leon Lett being caught from behind prematurely celebrating a touchdown back in Super Bowl XXVII. As I write this on Friday afternoon, the market rebounded a bit, closing up about 620 points, still over 2,000 off the pre-Liberation level.

Master strategy, indeed.

The Technical Aspects of All This

I found myself wondering yesterday just how the logistical aspects of all this bullshit were playing out. There have to be software systems that handle global trade, tracking where goods are coming from, applying the appropriate tariffs, collecting said tariffs, etc. I have to imagine that there are systems across industries as well, systems that handle pricing from suppliers to end users, etc. The rapid-fire changes to the tariff system must be a nightmare for the systems folks who are responsible for all this, I imagined. Hell, once a year I have to update pricing for a handful of labor rates and materials for a relatively small number of entities, and that is a pain in the ass. I really felt for anyone who has to deal with all of this, because you know that this administration gives no fucks about the complexities involved in dealing with that stuff. They probably think that you can just type in a number and everything updates automagically.

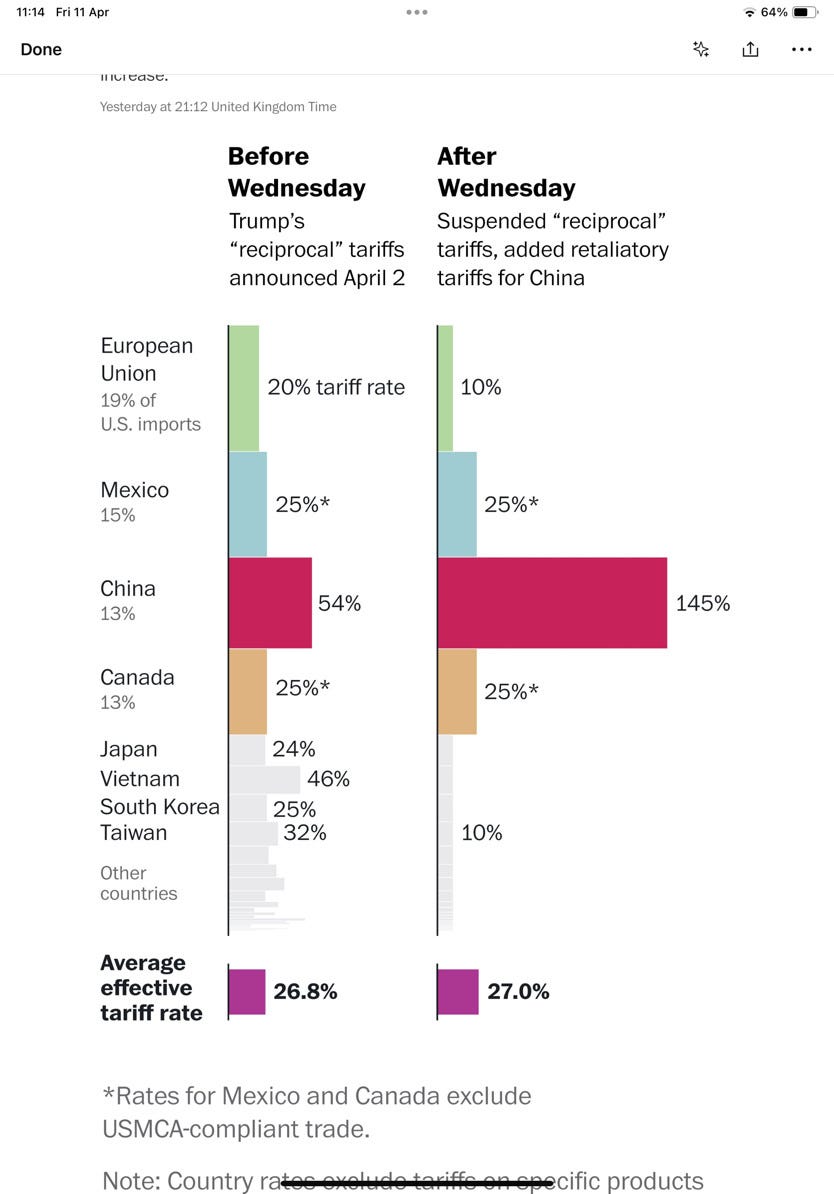

Well, apparently it is a problem. Reports came out today that, due to a “glitch” in the system, we are actually not collecting any tariffs. At all. If Customs can’t keep track of all of this, I have to imagine the problems trickle all the way down to individual stores. As with everything else these days, Trump has well and truly fucked things up. Hell, I would imagine that even he has no idea who has what tariffs right now. Fortunately, the Washington Post created this handy infographic:

So Where Do We Stand Now?

As of today (Friday, April 11th) the tariffs are paused. Of course, Dear Leader could shoot poorly in his golf tournament tomorrow and reinstate them over dinner. Before you scoff at that, think about it. He made a big show about how these tariffs were here for good, that we needed them. For… reasons. It stands to reason that he could decide to turn them back on at any time. After all, his unpredictability is a strength, right?

Speaking of reasons, why did we do these tariffs again? It seems that the answer to that question truly depends on who in the administration you ask, and when. During the run-up to Liberation Day (God that’s so stupid) we have heard that the tariffs are:

A matter of national security.

A response to a national emergency due to unchecked immigration at the border.

Retaliation for the unfair trade practices and tariffs foisted upon us by the entire rest of the world.

A beautiful way to usher in the new Golden Age in America by forcing production to come back to the United States, so that Americans could buy goods6 produced entirely within our borders.

A way to finance the extension of the Trump Tax Cuts.

So, which of the above were settled during the week between Liberation Day and Liberation from Liberation Day? Especially considering they were never actually implemented.

Anyone? Anyone? Bueller?

The answer, of course, is none of them. Nothing has changed, at least not for the benefit of the United States and its residents. What were we liberated from, other than trillions of dollars of wealth, and any last shred of respect the world may have had for the United States?

At the end of the day, we saw Dear Leader throw a Trumper Tantrum and the countries that matter told him to fuck off back to his room. Of course, the DC spin corps will not ever admit any of this, but by fucking with people’s money, Trump may have done damage that cannot so easily be hand-waved away, or consigned to the memory-hole he and his team are so skilled at hiding his other foibles in. The financial media has been less than impressed with all of this, and rightly so.

One last thing to keep an eye on: How will Trump use the threat of tariffs to get countries and companies to come to him, hat in hand with requests for carve outs and special dispensation. Hell, Trump has already been charging people millions of dollars to have dinner with him at Mar A Lago, so do the math.

And remember, this is only a “pause”. We could do all this stupid shit again in July. See you then!

Take Care and Stay Strong, Together.

We had to watch the futures tumble because Donny Deal was so confident that his tariffs would be gloriously received that he waited until after the markets closed for the day to put on his big show. Did he think that the markets, like half of the country and all of legacy media, would have moved on to the next crisis de jour on Thursday?

Except for China, who had the audacity to fight back and levy actual reciprocal tariffs on the US, kicking of a game of “I know you are but what am I” between Dear Leaders East and West.

Why does that sound so familiar? Oh yeah, it was the fake news that was first surfaced on Monday.

The rise of nearly 3,000 points didn’t come close to making up for the total losses of the previous four days of trading.

Gotta give credit to my lovely wife for introducing me to that handle. Oh, and the normal disclaimer that I will never live link to Musk’s hellsite, but I also won’t post a screenshot that I have not personally confirmed.

MAGA merchandise excepted, naturally.